- Accelerator/Decelerator Oscillator

- Accumulation/Distribution

- Alligator

- Average Directional Movement Index

- Average True Range

- Awesome Oscillator

- Bears Power

- Bollinger Bands

- Bulls Power

- Commodity Channel Index

- DeMarker

- Envelopes

- Force Index

- Fractals

- Gator Oscillator

- Ichimoku Kinko Hyo

- Market Facilitation Index

- Momentum

- Money Flow Index

- Moving Average

- Moving Average Convergence/Divergence

- Moving Average of Oscillator

- On Balance Volume

- Parabolic SAR

- Relative Strength Index

- Relative Vigor Index

- Standard Deviation

- Stochastic Oscillator

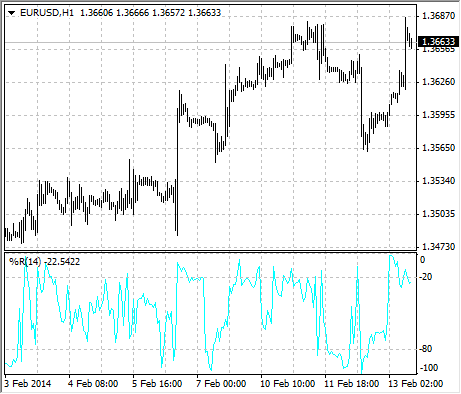

- Williams' Percent Range

Williams' Percent Range

Williams Percent Range Technical Indicator (%R) is a dynamic technical indicator, which determines whether the market is overbought/oversold. Williams %R is very similar to the Stochastic Oscillator. The only difference is that %R has an upside down scale and the Stochastic Oscillator has internal smoothing.

To show the indicator in this upside down fashion, one places a minus symbol before the Williams Percent Range values (for example -30%). One should ignore the minus symbol when conducting the analysis.

Indicator values ranging between 80 and 100% indicate that the market is oversold. Indicator values ranging between 0 and 20% indicate that the market is overbought.

As with all overbought/oversold indicators, it is best to wait for the securitys price to change direction before placing your trades. For example, if an overbought/oversold indicator is showing an overbought condition, it is wise to wait for the securitys price to turn down before selling the security.

An interesting phenomenon of the Williams Percent Range indicator is its uncanny ability to anticipate a reversal in the underlying securitys price. The indicator almost always forms a peak and turns down a few days before the securitys price peaks and turns down. Likewise, Williams Percent Range usually creates a trough and turns up a few days before the securitys price turns up.

Calculation

Below is the formula of the %R indicator calculation, which is very similar to the Stochastic Oscillator formula:

%R = - (MAX (HIGH (i - n)) - CLOSE (i)) / (MAX (HIGH (i - n)) - MIN (LOW (i - n))) * 100

Where:

CLOSE (i) – is todays closing price;

MAX (HIGH(i-n)) – is the highest maximum over a number (n) of previous periods;

MIN (LOW(i-n)) – is the lowest minimum over a number (n) of previous periods.